- FUJIAN CHANGHONG PRINTING MACHINE CO., LTD

- sale8@chprintingmachine.com

- +86 18150207107

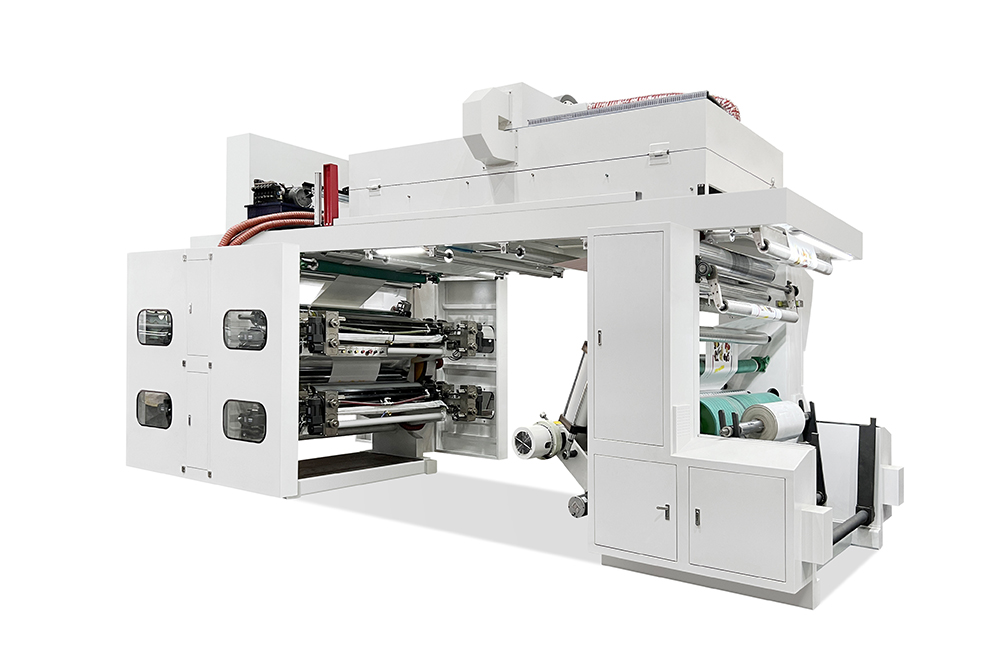

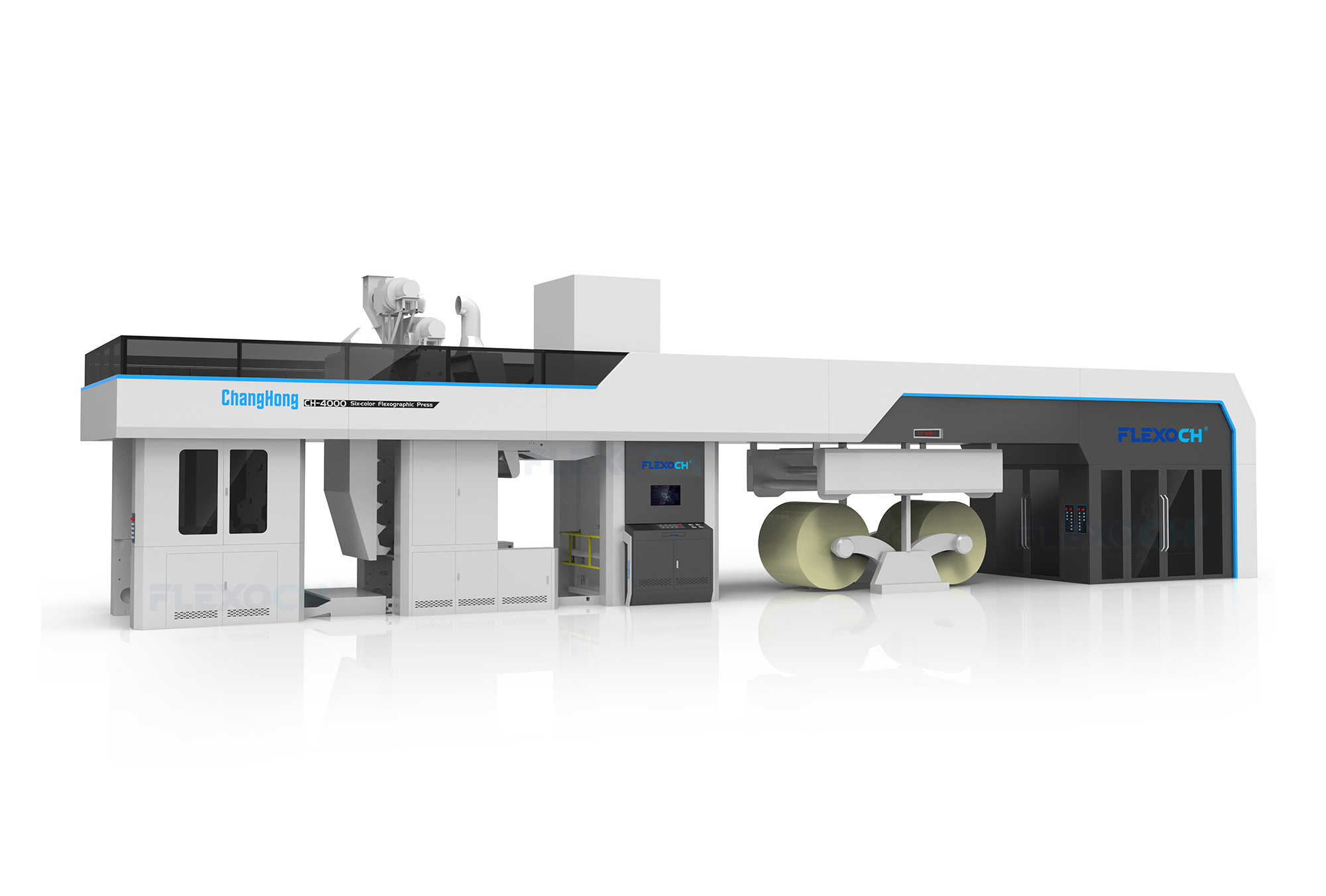

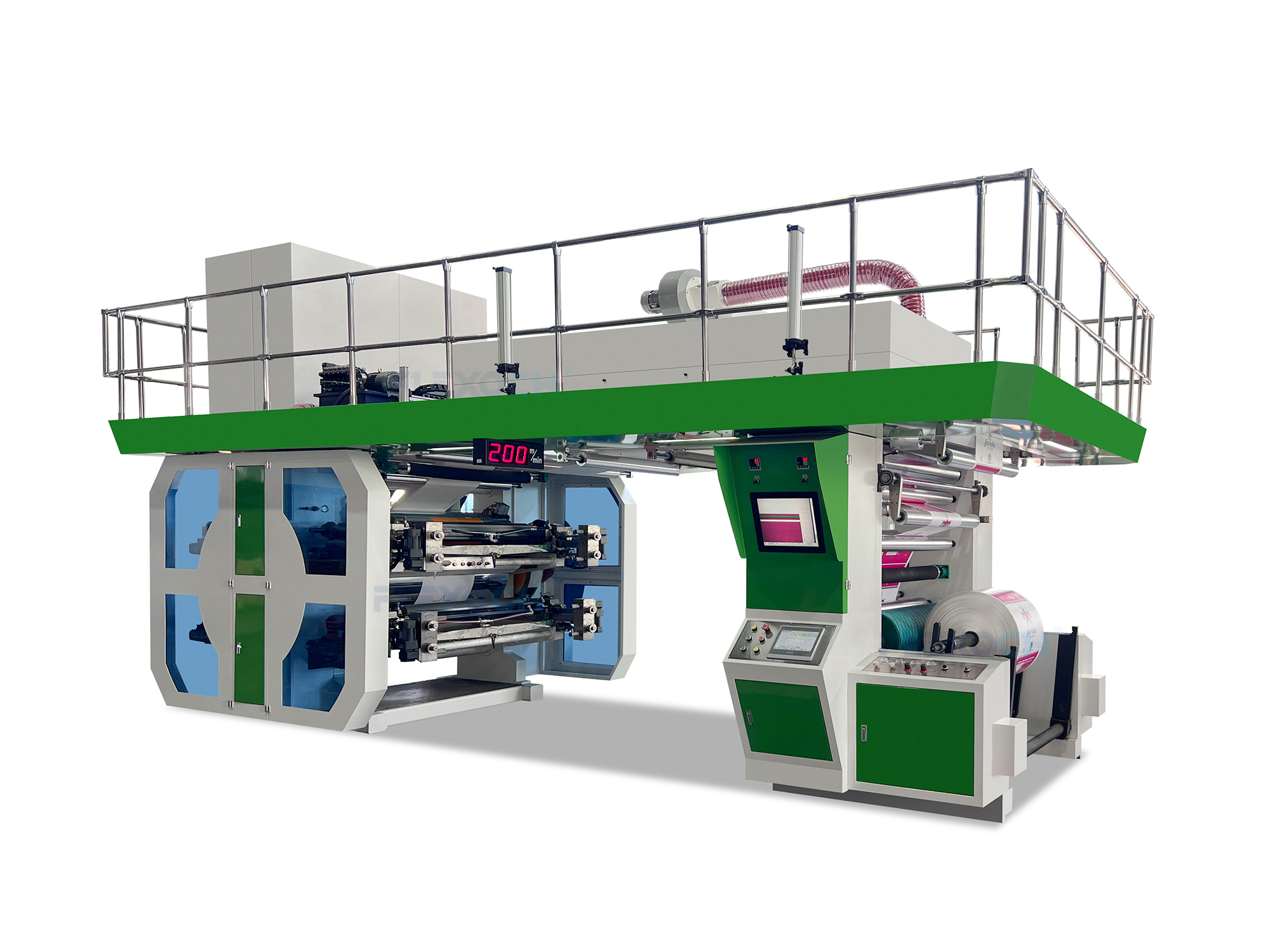

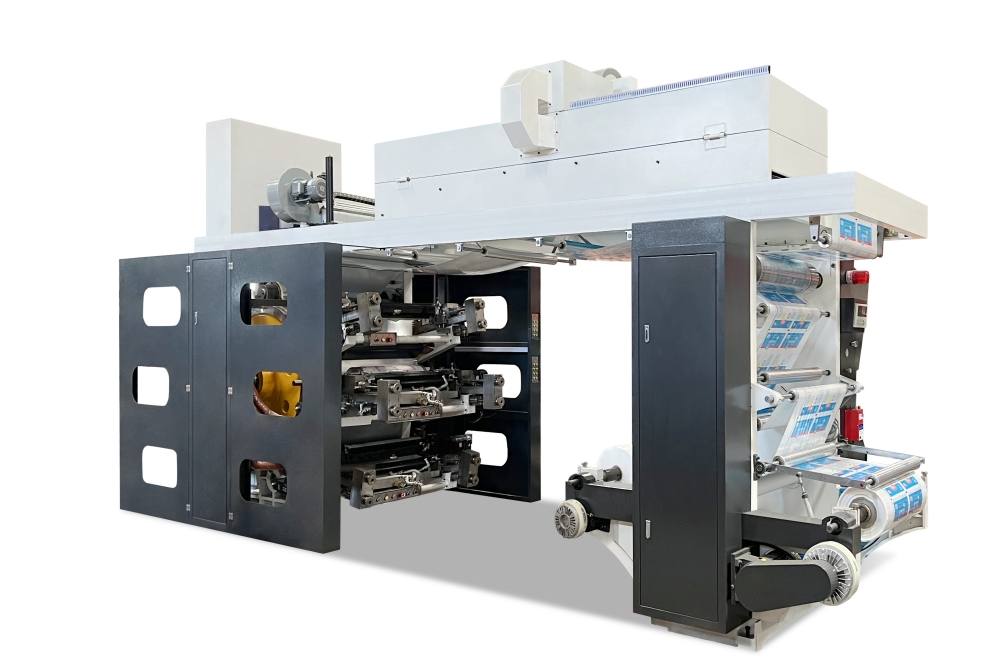

Top China Manufacturers of Flexographic Press and Printers

When it comes to high-quality printing solutions, flexographic presses and printers stand out, especially for businesses in China. I’ve seen firsthand how these machines can transform production lines, offering precision and versatility for various materials. They are perfect for manufacturers looking to enhance their output and quality. Our flexographic printers provide remarkable speed and efficiency, enabling you to meet tight deadlines without compromising quality. Being manufacturers ourselves, we understand the unique needs of B2B purchasers. We focus on creating machines tailored to your production needs, ensuring that every print job comes out perfectly. With advanced technology and user-friendly features, our flexographic presses empower you to innovate and stay competitive in the market. Partner with us, and let’s elevate your printing capabilities together!

flexographic press and flexographic printers in 2025 Ahead of the Curve

As we look ahead to 2025, the flexographic printing industry is poised for significant transformation, driven by advancements in technology, sustainability demands, and evolving market needs. Flexographic presses and printers are increasingly becoming the preferred choice for packaging solutions due to their ability to deliver high-quality prints on various substrates while maintaining efficiency and cost-effectiveness. As global buyers seek reliable partners, understanding the capabilities of the latest flexographic equipment is essential for staying competitive. Innovative features such as improved plate-making processes, faster drying times, and enhanced automation are reshaping the flexographic landscape. These advancements not only streamline production but also contribute to reducing waste and optimizing resource utilization, aligning with the global push towards more sustainable practices. Buyers looking to invest in flexographic technology in 2025 should prioritize suppliers that offer comprehensive solutions aimed at addressing these environmental concerns while boosting operational productivity. Furthermore, the demand for short-run packaging and customization continues to rise, pushing flexographic manufacturers to develop versatile solutions that meet the diverse needs of various industries. In this evolving market, flexibility and scalability are key. Companies that embrace cutting-edge technologies while remaining agile in their offerings will be well-positioned to capture new opportunities and drive growth. As procurement decisions loom, global buyers are encouraged to seek partners who not only innovate but also understand the shifting dynamics of consumer preferences in the printing sector.

Flexographic Press and Flexographic Printers in 2025 - Ahead of the Curve

| Category | Trends | Technology Improvements | Market Growth | Sustainability Efforts |

|---|---|---|---|---|

| Digital Integration | Increase in digital workflows and automation | Advancements in inkjet and laser technologies | Estimated growth of 6% annually | Focus on eco-friendly inks and materials |

| Customization | Demand for tailored printing solutions | Smarter software for design layout | Growing small business segment | Increased recycling practices in production |

| Speed and Efficiency | Shorter lead times for production | Faster drying and curing technologies | Increased capacity of printing machines | Progress toward energy-efficient processes |

| Quality Improvement | Higher quality standards for printed materials | Enhanced color management systems | Quality-driven growth segments | Adoption of biodegradable substrates |

Related Products